Description

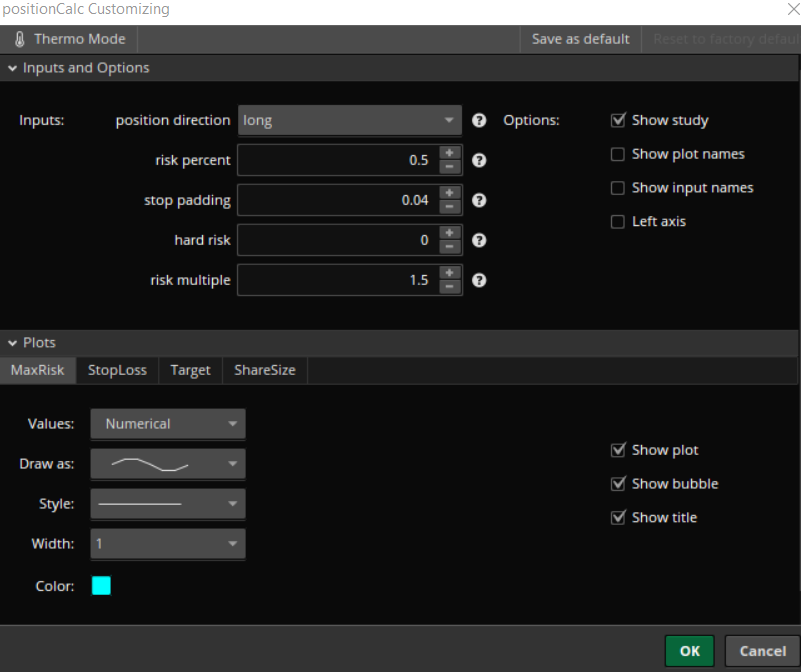

Options include position direction (long or short), risk percent, stop padding, hard risk amount, and risk multiple.

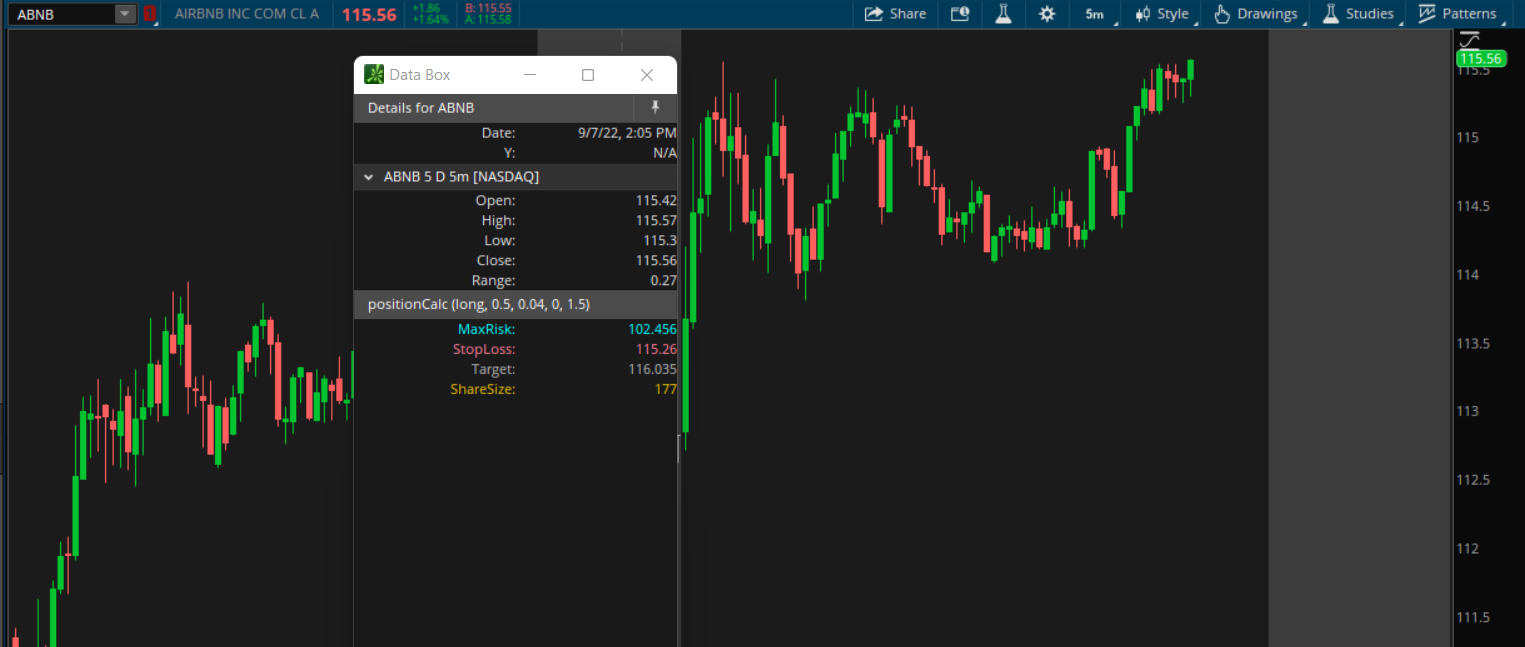

The output displays MaxRisk, StopLoss, Target, and ShareSize. The default output is formed based on values from the current candle. Hover over the candle in which you intend to enter the trade for the values to make your order.

Calculations are made in the following manner:

- Stop is candle [low] or [high] (depending on your position direction) with padding

- Target is [bar range] + [stop padding] * [risk multiple] +/- [high] or [low] (depending on your position direction)

- ShareSize is the either [risk] / [bar range to four decimal places] + [stop padding] OR [account net liquid] / [close] (rounded down)

- If the suggested size is greater than the maximum number of shares your account may purchase, the lesser of the two numbers is used.

There are other, more robust solutions out there…but they’re also much more expensive. I’m selling this at such a steep discount because I think it’s so very important. Most traders fail because they don’t practice good risk management. This takes the guess work and emotion out of the trades. All you have to do is find the setups!

Note:

- This study does not appear on the daily timeframe chart

- Share sizes are calculated using the trigger bar candle range to four (4) decimal places. As a result, you may see fewer shares calculated than you anticipate (this is hopefully a good thing).

Installation

Usage

DISCLAIMER: WE ARE NOT CERTIFIED FINANCIAL ADVISORS AND NOTHING IN THIS WEBSITE IS AN ADVERTISEMENT OR RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT, AND NEITHER ARE ANY OF THE PRODUCTS OR CONTENTS OF THIS SITE OR OUR SOCIAL MEDIA CHANNELS INTENDED TO INSTRUCT YOU ON HOW TO MAKE TRADING OR INVESTING DECISIONS. We provide custom thinkScripts and tutorials to help people use the ThinkOrSwim trading platform from TD Ameritrade. TD Ameritrade provides financial services including the trading of Stocks, Futures, Options and Forex, and this website is not affiliated with them in any way. None of our products are endorsed by TD Ameritrade or any of its affiliates. Due to the nature of our products being software, our policy is that all sales are final and there are no refunds or exchanges. That being said, we stand behind our work, and we will try to make sure our customers are happy any way we can. The information contained on this website is solely for educational purposes, and does not constitute investment advice. The risk of trading in securities markets can be substantial. You must review and agree to our terms & conditions of use, disclaimers & privacy policy before using this site.

U.S. Government Required Disclaimer – Commodity Futures Trading Commission. Futures and options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This website is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY, SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.